Introduction:

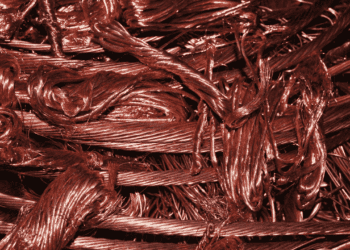

Copper, often referred to as “the metal of civilization,” holds immense significance in various industries due to its excellent electrical conductivity, malleability, and corrosion resistance. Understanding the price dynamics of copper, particularly in terms of 1 kg quantities, is crucial for investors, traders, and industry stakeholders. In this comprehensive guide, we delve into the nuances of 1 kg copper price, exploring market trends, trading strategies, and real-time rates.

Click Here For Latest – Copper Prices

Copper Market Overview:

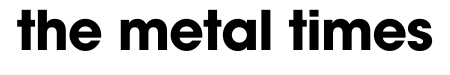

Before delving into the specifics of 1 kg copper price, let’s grasp an overview of the copper market. Copper is a versatile metal extensively used in construction, electronics, telecommunications, transportation, and manufacturing sectors. Its applications range from electrical wiring to plumbing, making it indispensable in modern society.

Join our: Whatsapp Group

Copper Uses and Applications:

Copper finds its application in various industries, including:

- Electronics: Copper is a primary component in electronic devices and wiring due to its excellent conductivity.

- Construction: In the construction sector, copper is used in plumbing, roofing, and electrical wiring.

- Transportation: From automobiles to trains, copper plays a vital role in ensuring reliable electrical systems.

- Manufacturing: Copper is utilized in the production of machinery, equipment, and consumer goods.

- Renewable Energy: The transition to renewable energy sources such as wind and solar power requires significant amounts of copper for wiring and infrastructure.

Click Here For Latest – Copper Rates

Copper Market Conditions and Industry Trends:

The copper market is influenced by various factors, including global economic conditions, supply and demand dynamics, geopolitical events, and technological advancements. Some key trends and conditions affecting the copper market include:

- Supply and Demand: Fluctuations in supply due to mine production, disruptions, and demand from emerging economies impact copper prices.

- Global Economic Outlook: Economic growth, particularly in China and other emerging markets, drives demand for copper in construction and infrastructure projects.

- Technological Advancements: Innovations in electric vehicles, renewable energy systems, and telecommunications drive demand for copper.

Click Here For Latest – Copper Rates

Trading Strategies for 1 kg Copper Price:

For traders and investors looking to navigate the copper market, understanding effective trading strategies is essential. Here are some strategies to consider:

- Technical Analysis: Utilize technical indicators and chart patterns to identify entry and exit points based on price trends and momentum.

- Fundamental Analysis: Stay informed about macroeconomic indicators, supply and demand forecasts, and industry news to make informed trading decisions.

- Risk Management: Implement risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

- Diversification: Spread risk by diversifying your portfolio across various assets and commodities, including copper futures and stocks of copper mining companies.

Click Here For Latest – Copper Rates

Real-time Copper Rate and Price Updates:

Monitoring real-time copper rates and price updates is crucial for traders and investors to capitalize on market opportunities. Various online platforms and financial news websites provide up-to-date information on copper prices, including:

- Commodity Exchanges: Platforms such as the London Metal Exchange (LME) and COMEX offer real-time copper futures prices.

- Financial News Websites: Websites like Bloomberg, Reuters, and CNBC provide comprehensive coverage of commodity markets, including copper.

- Mobile Applications: Mobile apps designed for traders offer real-time price alerts and market analysis tools for tracking copper prices on the go.

Click Here For Latest – Copper Rates

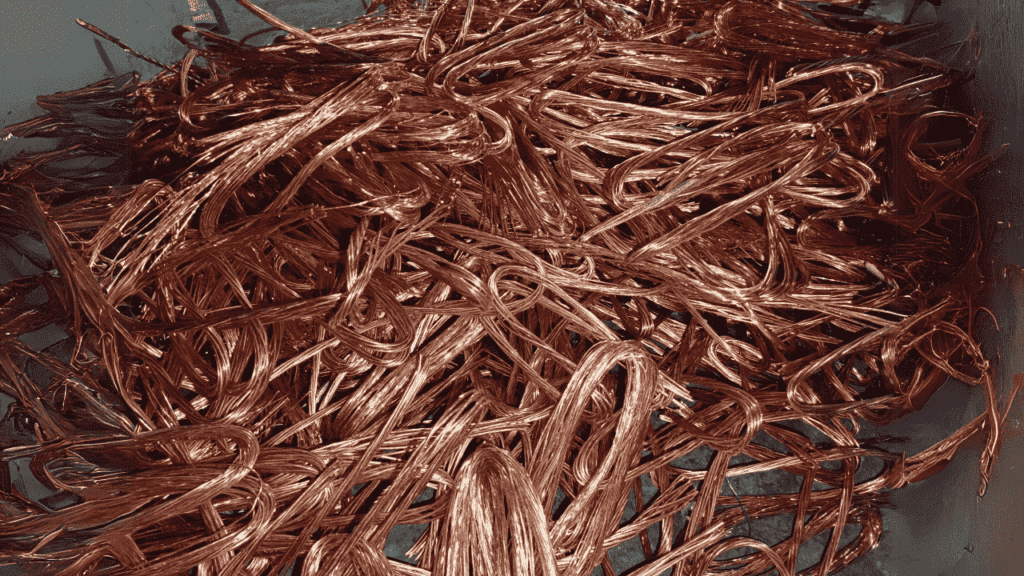

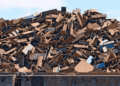

Comparison of 1 Kg Copper Prices:

| Source | Price per kg (USD) | Date |

|---|---|---|

| LME Futures | $7.50 | 2024-04-22 |

| COMEX Futures | $7.55 | 2024-04-22 |

| Scrap Yard | $6.80 | 2024-04-22 |

References:

- Copper Development Association Inc. (CDA)

- Investing.com

- Reuters

- London Metal Exchange (LME)

- COMEX

Join our: Whatsapp Group

FAQs (Frequently Asked Questions) about 1 kg Copper Price:

1. What affects the price of 1 kg copper?

- Various factors such as supply and demand, economic conditions, and geopolitical events influence copper prices.

2. Where can I check real-time copper prices?

- Real-time copper prices can be found on commodity exchange websites, financial news sites, and mobile apps.

3. How does copper usage impact its price?

- Copper is used in electronics, construction, and more. Changes in demand from these sectors can affect prices.

4. How can I invest in copper?

- Investors can invest in copper through futures, ETFs, stocks, and physical bullion.

5. What are some trading strategies for copper?

- Technical analysis, fundamental analysis, risk management, and diversification are common trading strategies.

Join our: Whatsapp Group

6. How do geopolitical events affect copper prices?

- Geopolitical events like trade disputes can disrupt supply chains and impact copper prices.

7. What’s the difference between LME and COMEX copper prices?

- LME and COMEX are two exchanges where copper futures are traded, with slight variations in prices.

8. How can I manage risks when trading copper?

- Setting stop-loss orders, diversifying portfolios, and staying informed can help manage risks.

9. What’s the role of copper in renewable energy?

- Copper is crucial for renewable energy systems like wind and solar power.

10. Where can I find historical copper price data?

- Historical copper price data is available on financial websites and through commodity exchanges.

Join our: Whatsapp Group

Conclusion:

In conclusion, understanding the dynamics of 1 kg copper price is essential for investors, traders, and industry participants. By staying informed about market trends, trading strategies, and real-time price updates, stakeholders can make informed decisions and capitalize on opportunities in the copper market. Whether you’re a seasoned trader or a novice investor, leveraging insights from this guide can help you navigate the complexities of the copper market effectively.

Join our: Whatsapp Group